Reading time: 20 minutes

Table of Contents

Summary

MapCraft has conducted a unique analysis that assesses the economic feasibility of building different multi-unit housing typologies across the country at prices attainable to middle-income households (i.e., 80-120% AMI). They find that nearly 100 million residents live in places where building multi-unit housing, especially missing middle-scale housing, could be feasible at middle-income prices under a supportive policy environment. These findings indicate that there is tremendous market-driven potential for middle-income housing production, particularly missing middle-scale housing, in many U.S. communities, and indicate that zoning, land use reforms, and other policy changes that facilitate housing production could yield substantial results.

Introduction

According to Up for Growth’s forthcoming 2025 Housing Underproduction in the U.S. report the United States is facing a housing crisis, with a significant shortfall of 3.78 million units. The stagnant housing supply directly contributes to increasing housing unaffordability across the nation. A major contributing factor to housing scarcity is zoning. As of 2019, 75% of land in most cities was exclusively zoned for single-family homes, severely limiting the ability to build diverse housing options and meet demand. The prevalence of restrictive zoning and land use regulations makes it difficult and expensive to build diverse housing options, which could offer more attainable homes.

Acknowledging these challenges, some cities and states have begun to implement policies and designs that encourage multifamily housing (like zoning for accessory dwelling units, multi-plexes, and cottage clusters in single family neighborhoods–often called missing middle-scale upzoning), aiming to increase supply and diversify housing options at more attainable price points than traditional single-family homes. Given that all fifty states face housing supply challenges, the crisis is truly national. Therefore, supportive federal policies are needed to amplify and assist work being done at the local level.

New analysis conducted by MapCraft for Up For Growth demonstrates that the market could feasibly support more multi-unit housing in response to zoning and land use reforms that make it easier to build more diverse housing typologies. MapCraft produced a nationwide analysis based on 2024 real estate economics that finds many Americans lived in markets where housing developers could have feasibly built multi-unit housing priced affordably for middle income households if policy conditions had supported it. Furthermore, feasibility is correlated with the places experiencing the greatest housing scarcity according to Up For Growth’s analysis of underproduction rates.

Executive Summary

MapCraft’s analysis of housing development feasibility found:

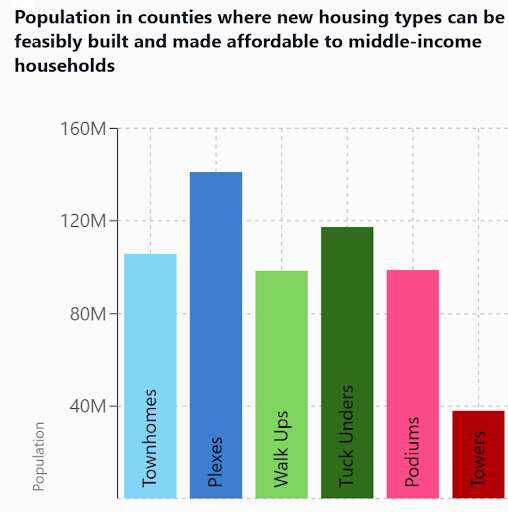

- In 2024, 90-140 million people (25-42% of US population) lived in a county where multi-unit housing could have been feasibly built and offered at an affordable price point to middle-income households.

- In supply constrained markets across the United States, the highest bidder for homes drives prices far above what middle-income households can reasonably afford. Removing multi-unit housing supply constraints can help new units be built. These new units could be built if policy enabled it and, under the right circumstances, could be priced affordably for the middle class, rather than being sold or rented at the top of the market.

- Many of the places that Up For Growth identifies as having the highest housing underproduction rates in this country were the metros where MapCraft’s analysis found middle-income housing could have been feasibly built. Applying the right policies in these supply constrained metropolitan areas could lead to more multi-unit housing and greater housing affordability.

- Townhomes and plexes (2-10 units) were most widely feasible. While more expensive building types like towers or mid-rises are also feasible to build for upper middle-income households in some places, plexes (small multifamily buildings ranging from duplexes to ten-plexes) were most widely feasible for households at the lower end of the middle-income spectrum.

Analysis Methods

MapCraft attempted to answer the question: Where can multi-unit housing actually be feasibly built and made affordable for middle-income households?

They created a web app using 2024 market, real estate, and population data to answer that question. Using the same financial considerations a developer would use, the app calculates the localized financial viability of building different housing prototypes when the units are sold or rented to the middle class.

Key Assumptions:

- Middle-income households are those making 80-120% of the area’s median income (AMI) and a home that is affordable is one that requires no more than 30% of a household’s income be spent on housing.

- There are sites in each county where land use regulations, like zoning, allow the development prototypes & land costs are 15% of total construction costs.

- Unit sizes and construction costs vary by building type and are based on local averages.

Middle-Income Housing Could Have Been Built Under More Supportive Policies

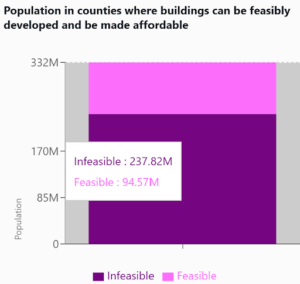

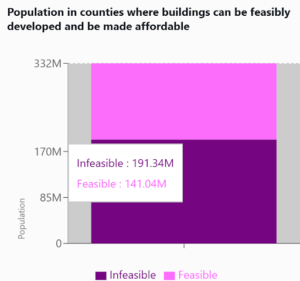

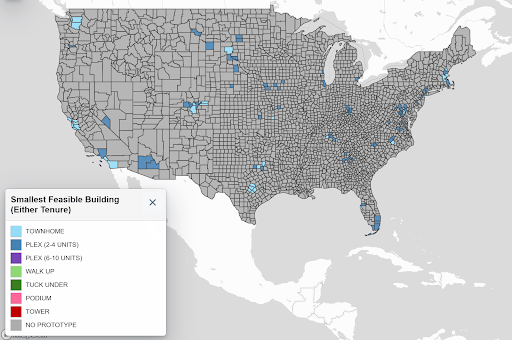

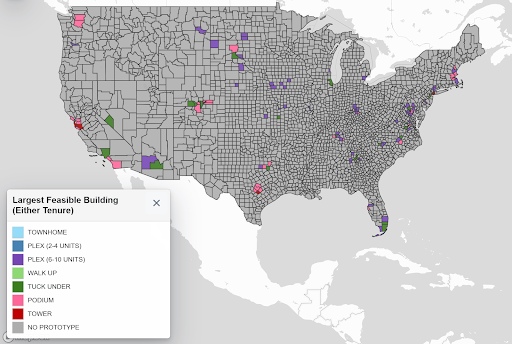

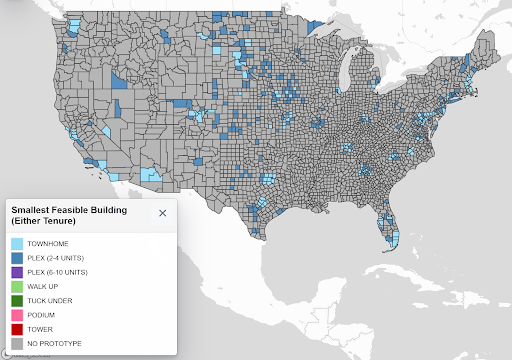

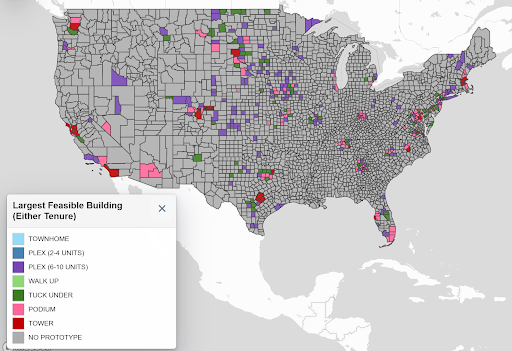

Mapcraft’s US Middle Income tool shows the population that live in counties where new multi-unit, middle-income housing could have been feasibly built in 2024 under supportive policy conditions (see the graphics below). The tool allows users to consider housing affordability for different middle-income households, which informs housing development feasibility. Results show that 94 million people lived in counties where multi-unit housing could have been built for households earning 100% AMI (shown left), while the number increases to 141 million people when considering affordability for households earning 120% AMI (shown right).

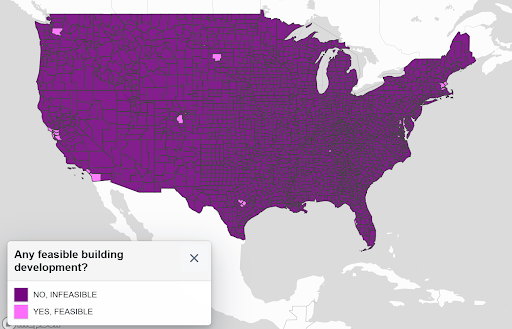

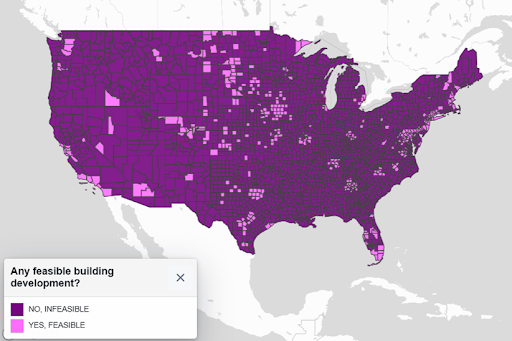

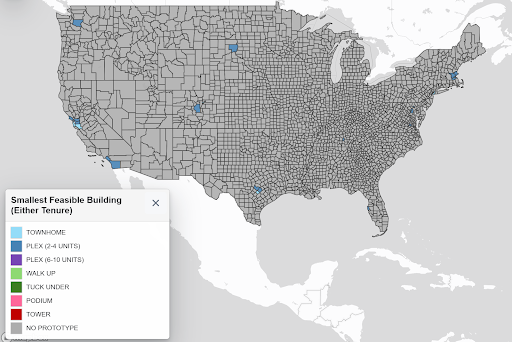

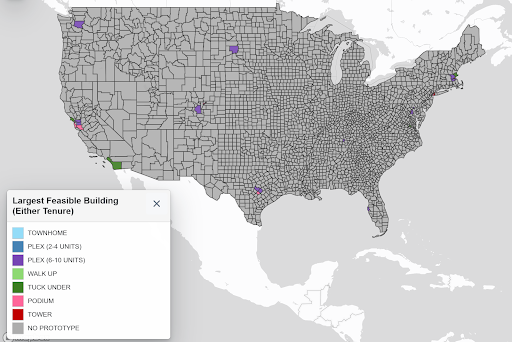

Zooming in closer, we can see the specific geographies where housing was feasible in 2024 for households earning 80% AMI (bottom of middle earners), 100% AMI (middle earners), and 120% AMI (top of middle earners). Many regions of the country show up as being feasible, especially when considering the higher end of middle-income households.

80% MFI

100% MFI

120%

When observing the housing that’s been developed across the United States we find that much of it falls into a single category: large, expensive single-unit detached homes. This is because the housing industry disproportionately supports the feasibility of single-unit dwellings, and many jurisdictions have regulations, like subdivision ordinances and zoning codes, that restrict most of their land area to single-family detached homes.

Many U.S. metros have housing markets where the demand for homes is high but the available supply is low. In these supply-constrained markets, the prices of homes are often driven up by the highest bidders, making them too expensive for many middle-income households. Building smaller, more affordable housing units is one way to address the issue of limited housing available to middle-income households. However, when land use regulations allow developers to build just one unit on a lot, developing a single large unit is generally more financially viable than building a smaller one. Building smaller units can be viable if cities permit developers to create multiple smaller units on a site, making the investment more attractive than building a single, large home.

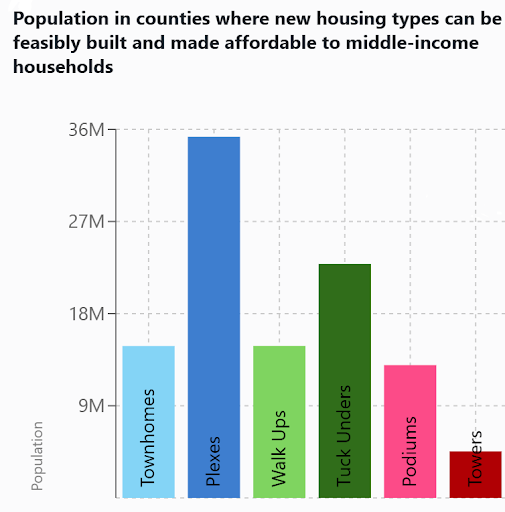

According to Mapcraft’s analysis tool, plexes were the most widely feasible multi-unit housing type for households on the lower end of the middle-income spectrum (earning 80% of the local median income), with the potential to be built in areas where over 35 million Americans reside. The feasibility of other housing types was less widespread when priced affordably for this income bracket, including tuck-under apartment buildings that were feasible in areas where 23 million people lived and townhomes and walk-up apartments that were feasible in areas where 15 million people lived.

Building smaller structures like plexes (duplexes, triplexes, etc.) is generally more cost-effective per unit than building larger structures, like high-rise towers or podium apartments, due to distinct structural designs, life safety features, and other factors. This makes them a more viable option for creating new housing that is affordable for middle-income households.

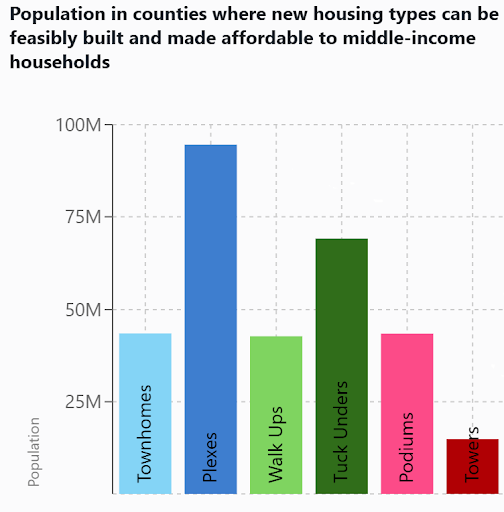

The analysis also found that for higher-earning middle-income households (making 120% of the local median income), a much wider range of housing—from townhomes to high-rise towers—could be feasibly built. However, even when considering housing constructed for this higher-income group, plexes remained the most widely feasible multi-unit housing type. This underscores the flexibility and adaptability of plexes as a housing solution that can meet the diverse needs of the middle-income population across a variety of locations.

Figure X:

| 80% MFI |  |

|

|

| 100% MFI |  |

|

|

| 120% MFI |  |

|

|

This data underscores the potential of housing policies to help address affordability challenges. New units could be feasibly built if policy enabled it and, under the right circumstances, be priced at a rate affordable to the middle class, not just sold or rented at the top of the market.

Cities need to change their policies to allow for more diverse and cost-effective types of housing, especially the construction of mid-scale, multi-unit housing such as duplexes, quadplexes, and walk-up apartments. By making it easier to build these smaller, more affordable homes, development costs can be kept in line with what middle-income families can afford.

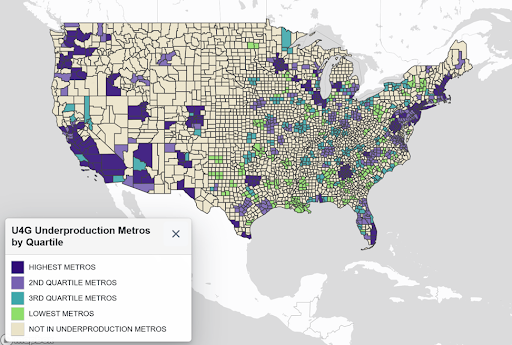

Housing Underproduction Correlates with Middle Income Housing Opportunities

All 50 states are now facing housing underproduction (a gap between the housing needed and the housing available); it is no longer a challenge only faced by expensive coastal states or the largest metro cities. For many middle-income families, this has made finding an affordable home nearly impossible. One means of solving this crisis lies in building what we call “missing middle” housing—smaller, multi-unit buildings like duplexes, townhomes, and small apartment complexes that are generally more cost-effective to build.

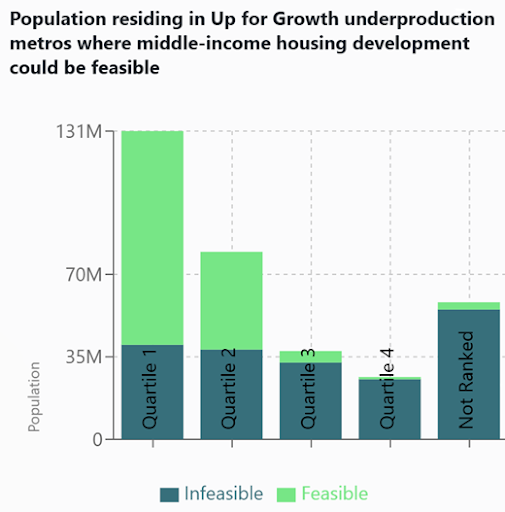

Mapcraft’s US Middle Income tool has identified a huge opportunity; middle-income, multi-unit housing development could be feasible in many of the very metro areas with the most severe housing shortages. Of the 130 million people living in severely supply constrained metro areas, 90 million reside in areas where developers can build new homes without government subsidies and still sell or rent them at prices that middle-income families can afford.

Developers can turn a reasonable profit while keeping housing prices in check in these specific areas due to low construction costs. But this requires development sites that are reasonably priced and subject to supportive land use regulations, which is seldom the case under current policies. By reducing barriers to housing development, we can address the country’s most pressing housing shortages and create affordable homes for middle-income families at the same time.

Metro areas with the highest housing underproduction and feasible for middle-income housing development (in descending order of largest Housing Underproduction Share Rank (largest housing gap at top):

| Market Feasible Quartile 1 Underproduction Metros | |||||

| UP Share Rank | Metro | Population | Households | Underproduction (Units) | Underproduction Share of Units |

| 1 | Oxnard-Thousand Oaks-Ventura, CA | 673,699 | 283,718 | 32,478 | 11.06% |

| 10 | Los Angeles-Long Beach-Anaheim, CA | 10,436,632 | 4,543,004 | 334,397 | 6.99% |

| 20 | Washington-Arlington-Alexandria, DC-VA-MD-WV | 4,710,430 | 2,259,793 | 144,445 | 6.11% |

| 24 | Boise City, ID | 558,994 | 271,103 | 16,115 | 5.75% |

| 28 | Bridgeport-Stamford-Norwalk, CT | 769,055 | 356,932 | 20,393 | 5.46% |

| 31 | San Jose-Sunnyvale-Santa Clara, CA | 1,533,197 | 665,550 | 37,496 | 5.36% |

| 39 | Minneapolis-St. Paul-Bloomington, MN-WI | 2,699,583 | 1,382,035 | 68,182 | 4.74% |

| 41 | Portland-Vancouver-Hillsboro, OR-WA | 1,919,908 | 961,690 | 46,469 | 4.65% |

| 45 | New York-Newark-Jersey City, NY-NJ-PA | 15,785,467 | 7,504,931 | 355,659 | 4.49% |

| 46 | Miami-Fort Lauderdale-Pompano Beach, FL | 5,064,404 | 2,338,549 | 112,772 | 4.49% |

| 47 | Phoenix-Mesa-Chandler, AZ | 4,065,086 | 1,916,646 | 90,557 | 4.46% |

| 50 | Santa Maria-Santa Barbara, CA | 337,467 | 150,932 | 6,782 | 4.31% |

| 54 | Seattle-Tacoma-Bellevue, WA | 3,284,809 | 1,627,693 | 72,800 | 4.23% |

| 55 | Boston-Cambridge-Newton, MA-NH | 4,044,852 | 1,974,900 | 87,342 | 4.23% |

| 57 | Denver-Aurora-Lakewood, CO | 2,163,814 | 1,102,476 | 46,936 | 4.07% |

| 58 | Albuquerque, NM | 657,672 | 332,808 | 14,208 | |

| 59 | Chicago-Naperville-Elgin, IL-IN-WI | 7,587,055 | 3,723,040 | 159,439 | 4.06% |

| 60 | San Diego-Chula Vista-Carlsbad, CA | 2,589,795 | 1,181,260 | 49,456 | 4.04% |

| 62 | Atlanta-Sandy Springs-Alpharetta, GA | 4,734,563 | 2,202,343 | 93,574 | 3.99% |

| 65 | Santa Cruz-Watsonville, CA | 207,581 | 99,069 | 3,989 | 3.85% |

| 73 | Portland-South Portland, ME | 472,265 | 244,997 | 8,715 | 3.40% |

| 77 | Dallas-Fort Worth-Arlington, TX | 6,306,927 | 2,933,063 | 103,440 | 3.30% |

Solutions

If missing middle housing at middle-income price points is feasible under the assumptions in MapCraft’s analysis, then why aren’t we seeing this development occurring out in the real world?

Part of the reason is that outdated zoning and land use regulations artificially constrain the market’s ability to create housing, especially missing middle housing. If there is only a small area of reasonably priced land where multi-unit housing is allowed and only a trickle of new multi-unit housing can be built, the prices of those homes will be high. Therefore, citywide zoning reforms and other policies are required to catalyze sufficient missing middle housing production, thereby increasing housing options with smaller and larger units, ensuring greater competition among landlords, and making the pricing of smaller units affordable for tenants and homebuyers.

Zoning and land use reforms are an essential first step to helping increase supply enough that the price points for development sites and new housing development can stabilize. The fact that so many communities with high underproduction are also areas where there could be feasible opportunities suggests that overly restrictive zoning laws are squandering these opportunities, and local zoning changes may have real benefits:

- Expanding by-right multifamily zoned areas.

- Allowing duplexes, triplexes, or fourplexes in areas zoned primarily for single-family residential homes.

- Allowing manufactured homes in areas zoned primarily for single-family residential homes.

- Allowing multifamily development in retail, office, and light manufacturing zones.

- Allowing single-room occupancy development wherever multifamily housing is allowed.

- Reducing minimum lot size.

- Ensuring historic preservation requirements and other land use policies or requirements are coordinated to encourage creation of housing in historic buildings and historic districts.

- Increasing the allowable floor area ratio by allowing a higher ratio of total floor area in a building in comparison to its lot size.

- Creating transit-oriented development zones.

- Streamlining or shortening permitting processes and timelines, including through one-stop and parallel-process permitting.

- Eliminating or reducing off-street parking requirements.

- Reducing or eliminating minimum unit square footage requirements.

- Allowing the conversion of office units to apartments.

- Allowing the subdivision of single-family homes into duplexes.

- Allowing accessory dwelling units, including detached accessory dwelling units, on all lots with single-family homes.

Policy Case Studies

This is not just theoretical. Many communities have responded to calls for increased construction by enacting policies that facilitate housing development.

Portland, Oregon

Portland has increased the housing supply and reduced the price of new homes entering the market by allowing middle-scale housing in single-family residential zones. There’s been over 1,400 permits for middle scale developments since legislation was passed in 2021. New homes are becoming more affordable, with the average new mid-scale home selling for $300,000 less than a new single-family unit. More people can buy into the market since the income required to buy a new middle-scale home is half of what someone would need to earn to buy a new single family house. And all this is being accomplished while preserving the existing housing stock as according to the City’s data, there has been no increase in demolitions.

Raleigh/Cary, NC

Cities in the region have achieved success largely through proactive land-use reform. In 2021, the City of Raleigh implemented fundamental zoning changes, enabling the construction of missing middle housing types—such as duplexes, triplexes, and townhomes—through a by-right approval process. These changes are credited with enabling the construction of 2,800 new homes, which account for roughly 30% of all new housing built since 2021. Meanwhile, the City of Cary embraced similar housing policies, passing a comprehensive plan in 2021 that laid the groundwork for zoning reforms. Among other strategies, Cary expanded the use of ADUs, further supporting the region’s efforts to increase housing supply.

Montana Miracle

In 2025, the Montana Legislature intensified its efforts on comprehensive housing legislation passed in 2023, known as the ‘Montana Miracle.’ To lower home prices and increase supply, the legislature implemented rules that reform land use controls in single-family and commercial zoning. Now, duplexes and ADUs are permitted by right on all single-family zoned properties. Six-story buildings are allowed everywhere, and parking requirements cannot exceed one space per unit for many mixed-use and multi-unit projects.

Role for the federal government

While zoning and land use policies are local issues, the federal government can support good policymaking and help support communities that may need help modernizing or reconsidering their land use patterns. There are multiple policies that should be adopted to enable sweeping change:

- Identifying Regulatory Barriers to Housing Act

- Build More Housing Near Transit

- Housing Supply and Frameworks Act

- Local Solutions Housing Act